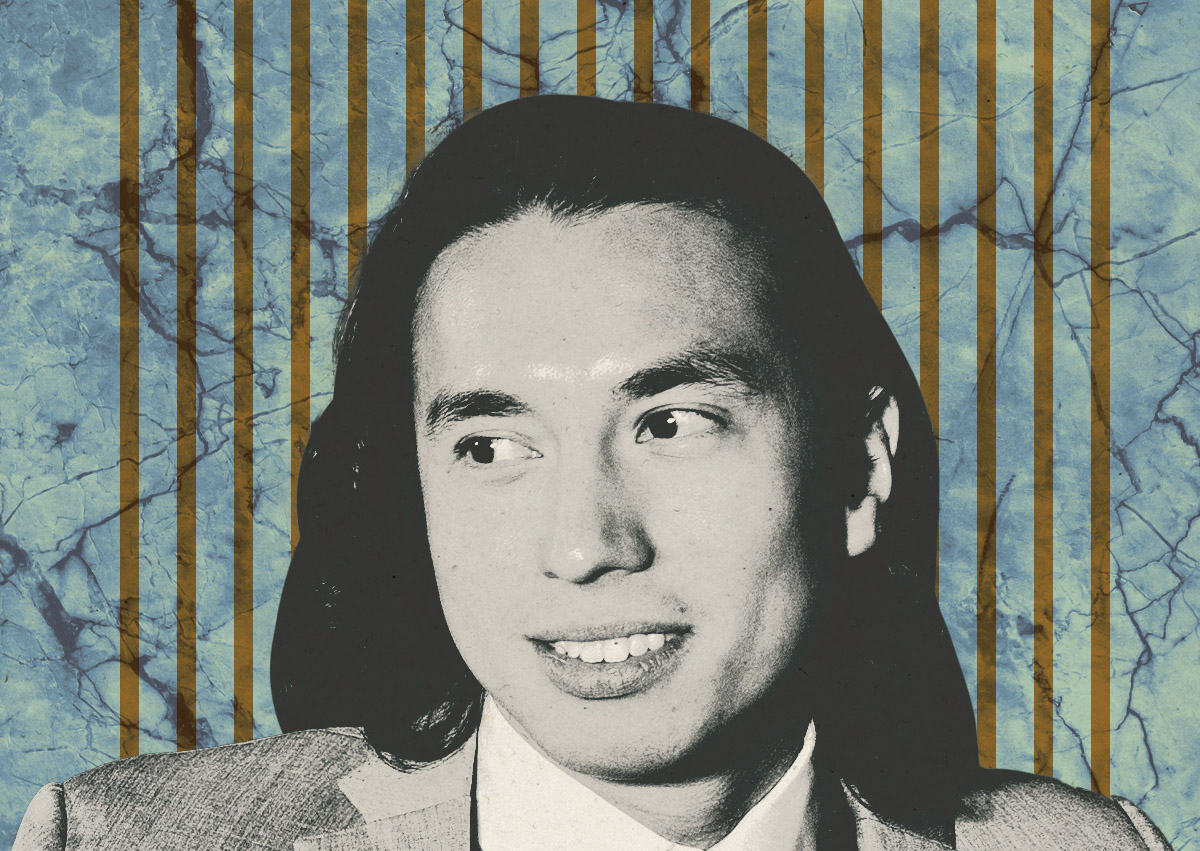

Disgraced developer Josh Schuster has been accused of stealing millions of dollars from investors for New York City real estate projects and using it to bankroll his lavish lifestyle, according to a newly unsealed federal indictment.

Schuster was arrested on Wednesday in South Florida, where he moved with his family after shutting down his troubled real estate development company, Silverback Development. From about 2018 to 2022, Schuster allegedly duped Silverback investors “through inaccurate statements of fund usage and exaggerated portrayals of his business’s reputation,” according to a statement released by prosecutors in New York.

Schuster, 41, is charged with one count of wire fraud and one count of securities fraud and faces up to 20 years in prison on each count.

Schuster stole more than $10 million to fund his lifestyle — which included private schools, country club memberships and a driver to shuttle him to nightclubs and networking events — to maintain the appearance of success and pay off other investors “in a Ponzi-like fashion,” prosecutors allege.

Schuster allegedly lured investors with the promise of equity in his real estate developments, claiming the money would be used for the acquisition and development of projects in Gramercy Park, Long Island City, the Bronx and other locations, per the indictment.

In reality, according to the lawsuit, he used the money to pay over $1 million in personal credit card debt and hundreds of thousands of dollars in gambling losses. Some of the money was allegedly used to repay earlier investors and cover unrelated business obligations and payroll.

In one instance, Schuster allegedly convinced an investor to put $23.6 million into a Queens development and cosign a $40 million construction loan, claiming the funds were earmarked for the project. Instead, he “improperly withdrew” $450,000 and used the money to pay a $180,000 credit card bill and $50,000 to pay an earlier investor, prosecutors allege. In 2021, he used money from the same investor to pay a $140,000 credit card bill, according to the indictment.

In 2020, Schuster allegedly used a $2.5 million investment in a Bronx project toward credit card debt and to pay the tuition for a New York City private school, along with other unauthorized expenses.

As a young condo developer in his 30s, Schuster built a reputation as a rising star in real estate. He got an early boost in his career from the $21 billion asset manager Silverpeak, which invested in a few of Schuster’s initial deals and invited his company to use some of its office space.

But Silverpeak later booted Schuster from its office and stakeholders claimed the developer built his success atop a platform of lies and misconduct. Court cases piled up. Several key members of his team left over alleged unscrupulous behavior they witnessed. And investors said at the time that Schuster misled them about how he used their money.

Schuster has maintained that many of the claims are inaccurate. He spoke candidly to TRD last year about his personal struggles and admitted that he maintained an image of success long after the reality had crumbled.

He moved to Boca Raton and started a new real estate venture, SolarBack, which leases commercial rooftops and installs solar farms. Schuster said in a text on Tuesday that the company had raised $300 million and has a portfolio of 200 buildings.

Schuster’s attorney could not immediately be reached for comment.

Read more

Is developer Josh Schuster’s fast rise spiraling out of control?

The Daily Dirt: Developers open up about failure, seeking help