The brutal selloff in AI-chip stock Nvidia offers investors an attractive entry point, Goldman Sachs argued on Monday.

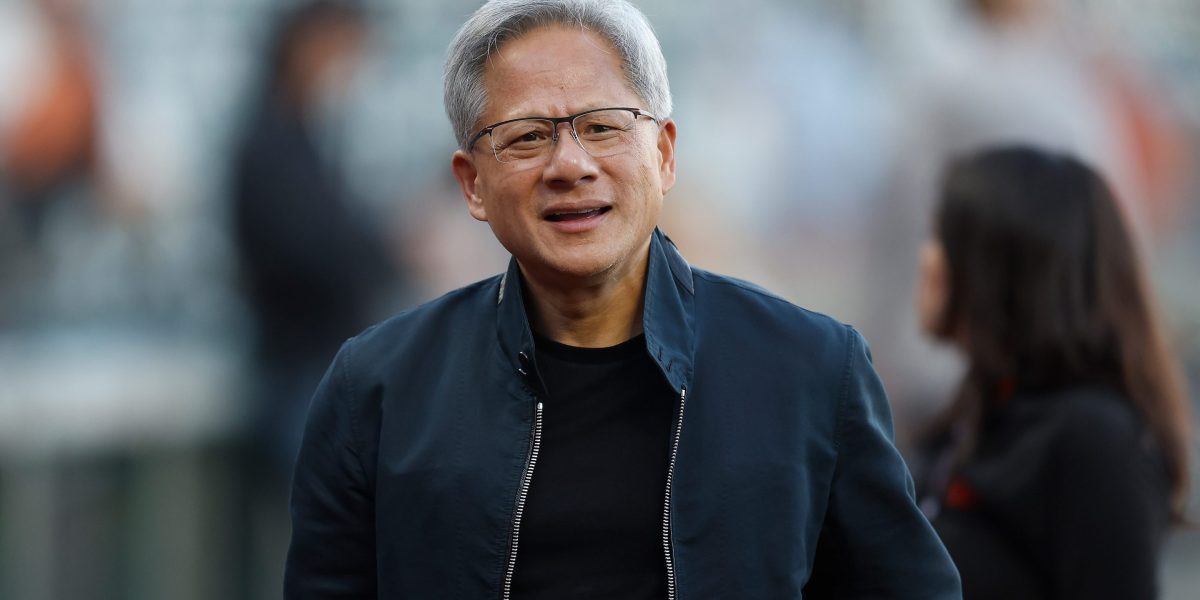

Founder and CEO Jensen Huang has seen his company lose 17% of its market cap since issuing muted third-quarter guidance that sparked concerns its rapid earnings growth may not be sustainable. Only a handful of companies are currently fueling its booming AI chip business, with just four customers constituting nearly half of all Nvidia’s revenue.

Speaking with Yahoo Finance on the sidelines of a tech conference hosted by his bank, Goldman Sachs semiconductor analyst Toshiya Hari remained confident sales will pick up as customers outside of the three cloud hyperscalers—Amazon, Microsoft, and Google—start to invest in their own AI compute clusters.

“Demand for accelerated computing continues to be really strong,” he said on Monday, reaffirming his “buy” recommendation on the stock and arguing the stock was oversold. “You are seeing a broadening in the demand portfolio into enterprise, even into sovereign states.”

Based on Hari’s estimates for Nvidia’s 2025 profits, Nvidia’s price-to-earnings multiple is in the low 20s thanks to the sharp pullback over the past couple of weeks. By comparison, Tesla trades at 77 times next year’s consensus earnings estimates, according to Yahoo Finance.

Custom silicon the latest trend among chip-starved Nvidia customers

Nvidia has driven this year’s gains in the S&P 500 index, but lately it has become a victim of its own success.

A combination of production bottlenecks and a lack of meaningful competition means customers are waiting to be allocated supply of Nvidia’s Hopper AI training chips. Those that are able to actually get their hands on this prized resource are paying through the nose, causing profit margins at Nvidia to balloon.

Unhappy with the lack of choice, tech companies—including Amazon and Tesla—are developing their own custom silicon rather than depending entirely on Nvidia. These proprietary chips can be fabricated at specialized foundries like Taiwan Semiconductor Manufacturing Co. (TSMC), bypassing Nvidia entirely.

Hari acknowledged barriers are dropping when it comes to the make-or-buy question, but argued the threat is overblown.

For one, Nvidia H100s command a 90% share of the AI chip market versus rivals like AMD’s MI300 series, so no one comes close to its technology. Those customers that are in the process of developing custom silicon are primarily interested in solving compute tasks unique to their businesses, Hari explained.

While these would represent lost sales that would have otherwise gone to Nvidia, the proprietary chips would not be suited for competing with Nvidia directly on the open market.

Hari cited Google as an example, saying the company is working on its own AI chips to help improve Google Search. By comparison, the group’s hyperscaler, Google Cloud Platform, showed no signs of a diminished appetite for Huang’s chips.

“They’re still buying a boatload of Nvidia GPUs, and you can make the same case for Amazon,” the Goldman Sachs analyst said. “Within merchant silicon, Nvidia is the go-to. And even versus custom silicon, they’ve got the edge in terms of pace of innovation.”

Goldman bearish on Intel, urging chipmaker to finally hit its guidance

At the same time, Hari remained bearish on Intel, arguing CEO Pat Gelsinger has an uphill battle.

Not only is Intel is losing the race with Nvidia, AMD, and Qualcomm on the product side, but its foundry business has no clear path to surpassing TSMC in terms of production technology.

Companies looking to outsource fabrication of their chips would not risk swapping out the Taiwanese giant for the inferior technology of Intel, argued Hari.

He rates Intel a “sell,” but offered some advice to Gelsinger on how to at least put a floor under the stock in the near term:

“For starters it would help for the company to start hitting what they guide to,” he said. “They’ve disappointed the market quite frequently, and that’s never good for a stock price.”

Neither Nvidia nor Intel could immediately be reached by Fortune for comment.

Data Sheet: Stay on top of the business of tech with thoughtful analysis on the industry’s biggest names.

Sign up here.