People in China are so discouraged about the economic outlook that many have taken to social media to call it the “garbage time of history,” referring to the end of NBA games when the result is settled and players go through the motions until time runs out.

Use of the phrase earned rebukes from state-run media over the summer, but it tapped into a deepening gloom that has spread to Wall Street as fresh data point to worsening weakness in top economic drivers. Bank of America recently cut its 2024 growth forecast to 4.8% from 5% and sees further slowing in the next two years to 4.5%.

In an article for the China Leadership Monitor last weekend, Rhodium Group partner Logan Wright said that while China is still growing faster many other countries, its global influence probably peaked in 2021.

That’s when it reached 18.3% of world GDP, before dipping to 16.9% in 2023. Meanwhile, the U.S. share is sitting at about 25%.

The problem isn’t just cyclical. Wright said “the primary reason that China’s economic slowdown is structural in nature is one that Beijing acknowledges: the credit and investment-led growth model has reached a dead end.”

All that capital fed massive property construction and infrastructure development. But noting has replaced them as growth drivers, and China’s teetering financial system is unlikely to give rise to any new ones, he wrote.

Credit expansion will slow, dragging down investment growth and the economy’s long-term prospects, he said. Meanwhile, the political leadership’s fear of letting defaults, bankruptcies and unemployment rise is preventing the financial system from channeling capital to more productive sectors of the economy.

“The financial system itself is now constraining China’s economic growth rather than facilitating it,” Wright explained. “In addition to demographics and the changing external environment, financial constraints are the primary reason why China’s economic slowdown is structural in nature and why China’s economy is likely to grow at rates below potential over the next decade.”

To be sure, Beijing has known its old growth model couldn’t last and has promoted advanced manufacturing in emerging sectors like EVs and green energy as alternatives. But those aren’t big enough to offset declining property or infrastructure construction, he said.

China’s leadership has also identified the need to rebalance the economy toward more consumption instead of investment. But that’s hampered by income inequality that requires an overhaul of fiscal policy to prioritize transfer payments that boost household spending.

Given the obstacles, what’s likely to happen is that consumption growth will continue to decline gradually and weigh on future economic growth, Wright predicted.

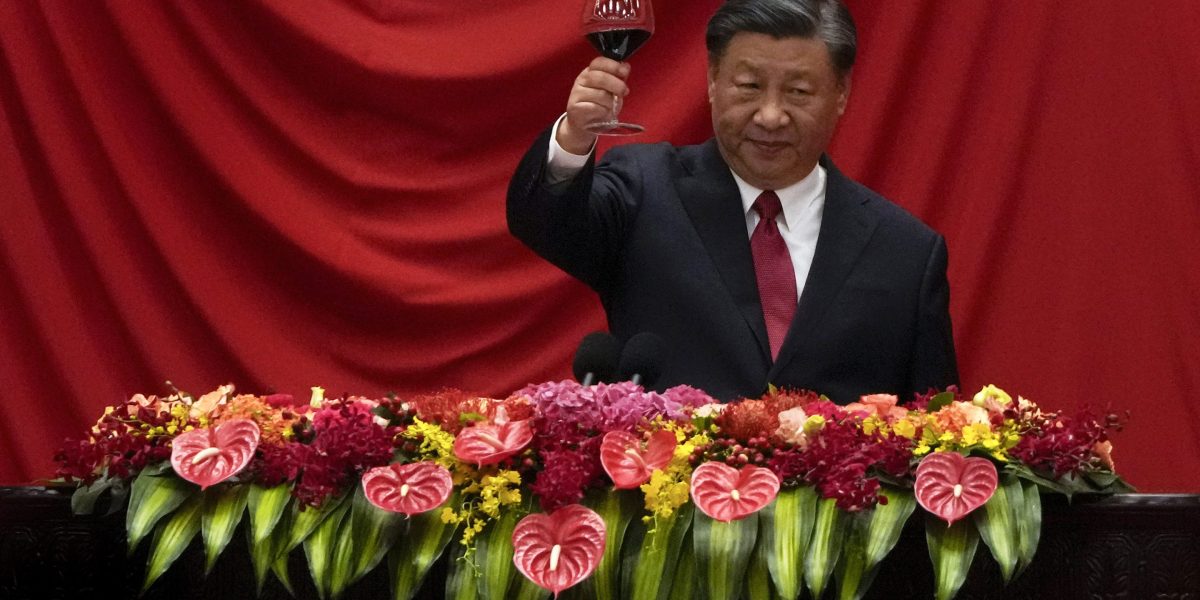

President Xi Jinping and China’s other leaders may not fully grasp the severity of the situation, as the official economic statistics they digest look increasingly dubious. At the same time, they also appear fixated on overtaking the U.S. as the world’s top economy.

But if Xi and company can change their worldview, it could help the Chinese economy, Wright said. For example, export-led growth that relies on taking global market share sparks trade barriers. By contrast, focusing more on domestic consumption could reduce trade conflicts.

Still, he’s not convinced it will happen.

“China’s economy peaking in global influence also offers Beijing a new opportunity to realistically redefine its goals and to become less confrontational with the rest of the world’s economic and political interests,” he said. “But we are under no illusions that such a redefinition is probable.”

The warning comes as investors have also been jolted recently by red flags about China’s economy.

PDD Holdings, the parent company of e-commerce giant Temu, stunned Wall Street last month with weak quarterly results and a warning that intense competition will dampen future profits. Shares sank more than 30%, wiping out $50 billion in PDD’s market value.

That was the latest warning sign that the world’s second-largest economy could be headed for a downward spiral caused by overproduction and Beijing’s industrial planning.

“Simply put, in many crucial economic sectors, China is producing far more output than it, or foreign markets, can sustainably absorb,” wrote Zongyuan Zoe Liu, a China scholar at the Council on Foreign Relations, in Foreign Affairs magazine before the PDD reported earnings. “As a result, the Chinese economy runs the risk of getting caught in a doom loop of falling prices, insolvency, factory closures, and, ultimately, job losses.”

In our new special issue, a Wall Street legend gets a radical makeover, a tale of crypto iniquity, misbehaving poultry royalty, and more.

Read the stories.