If New York City housing is so expensive, why do 8.5 million people live here?

One reason is that the rent burden isn’t as high as it seems, because it doesn’t account for the lower transportation costs of city living.

Statistics about “rent-burdened” households refer to families that spend more than 30 percent of their income on housing. But financially, a car-less New York City family spending 35 percent on rent is doing better than a car-dependent Los Angeles family spending 25 percent.

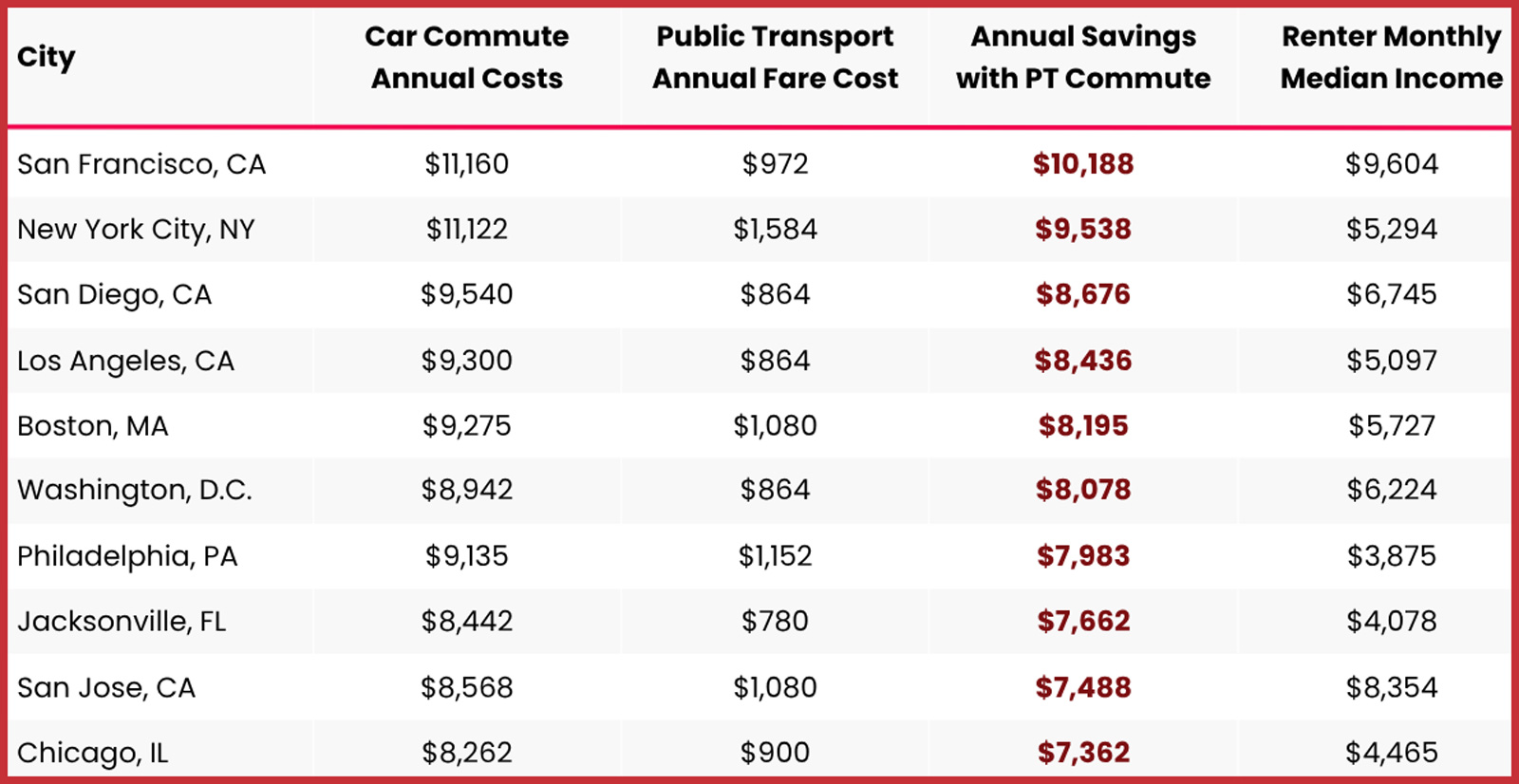

Driving costs more than many realize. Auto insurance, fuel, maintenance and parking averages $8,000 a year, according to various studies, including one just released by Point2Homes.com. The average is more than $11,000 in New York and San Francisco. And that doesn’t include car payments.

Meanwhile, the average annual cost of taking public transit is $972 nationally and $1,584 in New York City. (The actual NYC number is surely less than $1,584, because so many Gothamites are habitual farebeaters.)

For the real estate industry, mass transit matters a lot. In places where people can get around without a car, landlords can charge higher rents, at least for free-market units. In cities like L.A., a family might need two vehicles.

This is not to downplay housing costs in New York, which (except for rent-regulated tenants) are undeniably high because of high demand and low supply. But renters and homeowners can spend more of their income on housing if they live car-free.

Here’s the list of the top 10 cities for mass transit savings:

What we’re thinking about: Will the Trump administration really take over Penn Station renovations from the Metropolitan Transportation Authority, as the New York Times reported? If it does, how will it change the plan — or fund it? Send your thoughts to eengquist@therealdeal.com.

A thing we’ve learned: Eric Hanninen paid $5.8 million for the four-story building at 349 West 46th Street, the 18-year home of the Ritz Bar and Lounge, which he is renovating. A reopening of the Hell’s Kitchen venue is planned for next month. Hanninen says the revamped establishment will be one that “celebrates queer culture.” Serhant had listed the property for $6.5 million.

Elsewhere…

Despite the economic uncertainty triggered by tariffs, lots of real estate deals are happening, according to longtime real estate attorney Jay Neveloff.

“I’m seeing a tremendous amount of activity, even though the stock market is causing disruption,” he said Thursday after a lunch with seven other real estate professionals.

He cited several factors: “stability in interest rates; lenders want to get paid back and are finally being proactive instead of kicking the can down the road, as they had been doing; and private equity firms just want their money back.”

He also theorized that the recent stock market volatility could make New York City real estate more attractive to investors seeking stability.

Closing time

Residential: The priciest residential sale Thursday was $9.5 million for 2,800-square-foot Unit W18C at 500 West 18th Street, the new One High Line condominium. Deborah Kern and Steve Gold of the Corcoran Group had the listing.

Commercial: The most expensive commercial closing of the day was $46.8 million for 85 Fifth Avenue. The 13-story building in Flatiron is more than 100,000 square feet. SL Green was the seller.

New to the Market: The highest price for a residential property hitting the market was $27.5 million for 101 West 67th Street’s Unit PH3B. The Millenium Tower condo unit is 5,100 square feet and last sold in 2012 for $20.8 million. The Corcoran Group’s Deborah Kern has the listing.

— Joseph Jungermann