Neobank Jupiter is in talks to acquire a stake in SBM India, three sources familiar with the matter told TechCrunch, the latest example of an Indian fintech startup pursuing strategic partnerships with traditional banking institutions.

The Bengaluru-headquartered startup — backed by Tiger Global and NuBank — is engaging to buy a 5% to 9.9% stake in SBM India, the local arm of SBM Bank, sources said, requesting anonymity as the deliberation is ongoing and private.

A deal is yet to be finalized, which will also require approval from the Indian central bank, the Reserve Bank of India, the sources added.

The talks follow a broader trend among Indian fintech startups as well as venture capital firms that are seeking to forge ties with lenders in the South Asian market. Indian fintech Slice received RBI’s approval to merge with North East Small Finance Bank last year in a move that it said would allow the firm to “serve a wider audience, including those often overlooked.”

VC firms Lightspeed and Sorin recently invested in Shivalik Small Finance Bank, following investments by Accel and Quona in the lender. TechCrunch previously reported that Lightspeed was in talks to back the lender.

Premji Invest, Multiples, Zerodha, Gaja Capital and MobiKwik were among those who were evaluating an investment in Nainital Bank, a subsidiary of Bank of Baroda, TechCrunch reported earlier this year.

Jupiter and SBM India didn’t immediately respond to a request for comment.

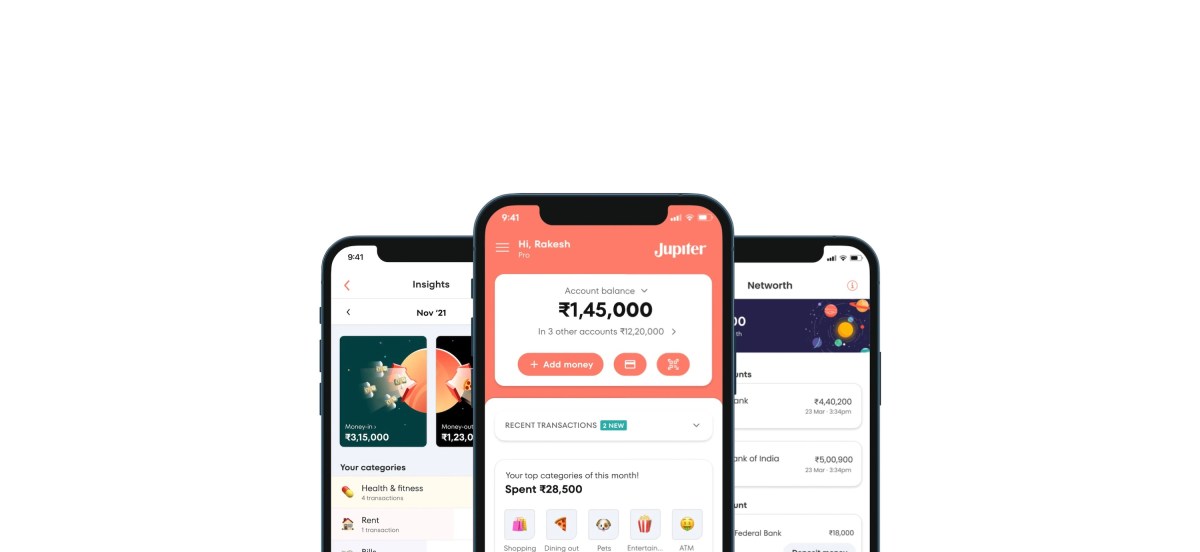

A so-called neobank, Jupiter partners with Federal Bank to provide its Indian customers with modernized financial services. However, the adoption of such neobanks in India has lagged behind other markets, such as Brazil, where they’ve gained traction more rapidly.